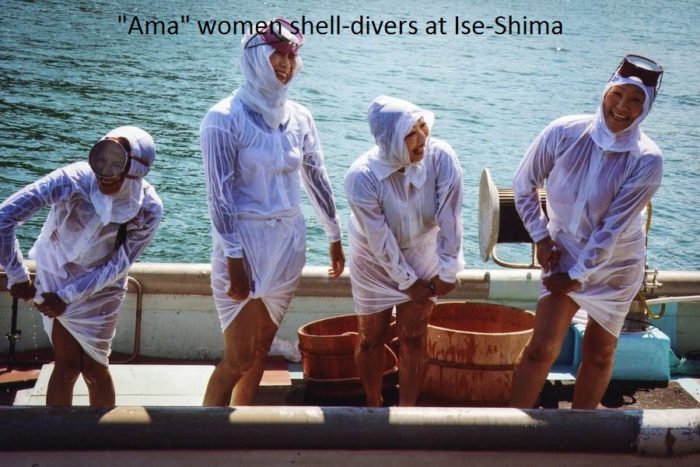

Interview with independent French website Atlantico on the occasion of the G7 meeting at Ise-Shima, 24/5/2016

Q. After more than 3 years, what are the results of the Abenomics policies?

A. In a nutshell, mission half accomplished.

The aim of Abenomics was to reflate an economy that had been in post-bubble deflation since the mid-1990s. It proposed a mixture of monetary, fiscal and structural reforms, but the main focus was monetary.

Looking at the Japanese economy, what do we see today? The Misery Index (the sum of the unemployment rate and the inflation rate) is the second lowest amongst the 34 OECD countries, behind Switzerland. The percentage of the working age population actually in work is the highest ever. The rate of corporate bankruptcy is the lowest in 20 years. Even the suicide rate has fallen 30% from its peak earlier this century.

Most important, however, is what has happened to Nominal GDP, which did not grow at all between 1992 and 2012. In 2015 it grew by 2.2%, which may not sound like much, but is the best growth since 1995. That was enough to cause the ratio of public debt to GDP to fall for the first time since the Japanese economic bubble burst in 1990.

Raising NGDP growth above the rate of interest is the basic mechanism of monetary reflation. Without that, debt will compound up in perpetuity, regardless of what other policies the government implements. Pre-Abe, that was the situation.

Unquestionably, though, there is further to go. It took a long time for Japan to get into deflation and it will be a multi-year process to emerge. Specifically core inflation has risen from -1% in 2011 to 1.1% currently, but remains well short of the Bank of Japan’s 2% target. Of course no other central bank in the developed world is close to its target either.

Q. What was really new in this policy mix? Did Abenomics mark a major political shift in Japan?

A. Abenomics was new in that monetary reflation had not been tried before, even though Japan had been in deflation since the late 1990s and endured not one, but two severe banking crises in 1997 and 2002.

It was said that Japan had been experiencing “very low interest rates “ for a long time, but that was not the case since, as mentioned, interest rates were locked above the rate of growth in NGDP. So in fact interest rates were too high!

People expected this situation to continue indefinitely, as the authorities seemed quite fatalistic about economic stagnation. For example, the Bank of Japan laid out a theory of “good deflation,” which purported to show that deflation was inevitable and indeed healthy.

Under Junichiro Koizumi, who was prime minister between 2001 and 2006, the emphasis had been on “structural reform.” At the same time Japan persistently intervened directly in the currency market, with the tacit approval of the US, in order to promote the competitiveness of its exports.

In the period leading up to the Global Financial Crisis, the Japanese economy did reasonably well on the surface, but the underlying deflationary forces were unchanged. During the crisis the Japanese economy took a massive hit of minus 8% of GDP. Even so from 2009 to 2012, the Bank of Japan’s inertia led to the yen rising to 78 to the US$. A super-strong currency in a shrinking economy – that’s the last thing you need.

Abe changed all that. He understood that a German-style policy of hard money plus structural reform would not work and was in fact disastrous in an era of deflation.

Q. How did Shinzo Abe sell this policy to the population? Considering that Japan has a very aged population, how did Shinzo Abe maintain his popularity?

A. In purely political terms, Abe has been a great success. He has won several landslide victories in national elections and his approval rating in opinion polls remains above 50% after three and a half years in office, which is almost unprecedented.

Land / housing prices have been rising, which is beneficial in an economy where the owner-occupier ratio is 62%.Wages have been rising too, especially at the lower end of the labour market where there are structural shortages. Hourly wages for part-time workers – who account for over one third of the workforce – are rising at around 2.0% year on year.

We have to mention demographics and immigration here. Japan is an aging society, but has not sought to use mass immigration as an “answer” to the problem. The benefits of a tight labour market are not just economic, but also social and political. A lot of unemployed young males means a lot of trouble. In Japan the youth unemployment ratio (15-25 year olds) is 6%. In the Eurozone it is 26% and even in the UK 16%.

The crucial point is that Japan was psychologically ready for Abenomics. People realised that the previous policy mix – perpetual austerity – was not sustainable.

Q. What can be the reason behind the Abenomics bashing (very strong in France) that can be seen worldwide? How could we explain this perception gap?

A. Foreign media coverage of Japan is generally poor and the whole subject of reflation is highly contested in ideological terms in many countries. Furthermore, Abe himself is considered a “nationalist”, which is simply a way of saying a patriot that you don’t like. Anyway, he has become something of a hate figure to a certain type of “righteous” foreign journalist and academic.

Japan usually gets a terrible press overseas. Frankly it is a place where not much happens so journalists have to exaggerate and distort in order to get anything published at all.

So it is quite likely that educated people in Europe who rely on the media for information will not get a true picture of Abenomics. Many people want Abe to fail and will rejoice if he does, just as many people rejoiced when Margaret Thatcher died. When your enemies rejoice at your death, it shows you have achieved something considerable.

Q. What have been the errors made by the government? Does Abe still have enough cards in hand to improve his results?

A. Yes, Abe has made errors, which is not surprising since we are in uncharted waters in terms of economic theory. In fact economics itself has been badly exposed in the years since the GFC.

Suppose you had asked a group of economists 10 years ago to imagine the following conditions in the UK a) sky-high fiscal deficit, b) sky-high current account deficit, and c) enormous quantitative easing. If you then asked them to forecast the level of UK interest rates, they would almost certainly have said double digits. In fact those are the conditions in the UK today, yet 10-year bond yields are currently near 1.3%, the lowest level in history.

In other words, the experts and the authorities have consistently underestimated the power of the deflationary forces at loose in the world.

Abe made a huge mistake in raising the consumption tax from 5% to 8% in the spring of 2014 and the Japanese economy has yet to really recover from the blow. He was advised to make this move not just by the Japanese Ministry of Finance, but also by the IMF, the OECD, the US ratings agencies, and influential global media like The Economist magazine.

How can a consensus of such great minds be wrong? Very easily, is the answer. It has happened time and time again, but especially in the aftermath of the GFC conventional thinking has failed utterly.

All the dire warnings about the risks of Abenomics have turned out to be the wrong way round. Instead of soaring interest rates and a collapsing yen, the favoured scenario of many “bears”, Abe’s most pressing problem in 2016 is an overly strong currency and subterranean bond yields right along the curve.

We have learnt from the experience of recent years that standard quantitative easing does not cause hyper-inflation, in fact has only mild positive effects on inflationary expectations and actual inflation. It may need to be used in combination with expansionary fiscal policy to have lasting impact on the real economy.

I hope that Abe will ignore the warnings of the usual suspects (see above) and reboot his programme, coming up with an Abenomics 2.0 that brings fiscal policy into the mix, while continuing with monetary reflation. He has the cards, alright. But he will need to trample on the sensitivities of the fiscal hawks and deflationists in order to play them.

Q. Is Abenomics replicable in the Eurozone?

A. Reflation can be implemented anywhere. The constraint is always political. The EZ is very complex politically, which makes the adoption of any aggressive new policy problematic – particularly if it involves the co-ordination of fiscal policy. For the politics to become feasible, you need the status quo to be recognized by both the general public and the policy-makers as unsustainable, which is not the case currently. A banking crisis in Germany or an existential threat to the EZ itself might provide the necessary catalyst, but who knows when that will happen? We could be years away from the denouement.